Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. AS PER COMPANIES ACT 2013.

The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year.

. The Board can only recommend the amount of dividend. The company is required to deposit the amount of dividend so declared within 5 days from the date of declaration of Dividend ie. As per provisions of the Companies Act 2013 the dividend is declared by the Company in the following way-.

1440E dated 29th May 2015. Inserted by the Companies Amendment Act 2015 vide Notification No. PDF uploaded 1772019.

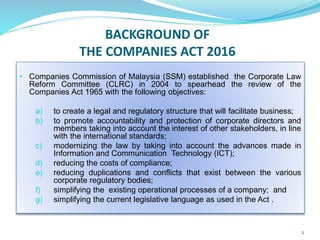

Applicable from accounting period commencing on or after 01042016. After due consideration SSMs Board formally accepted 183 out of the 188 recommendations which were then consolidated into 19 Policy Statements which formed the basis for the Companies Act 2016. Pursuant to the application of a companys share premium account towards payment of dividends if such dividends are satisfied by the issue of shares ie.

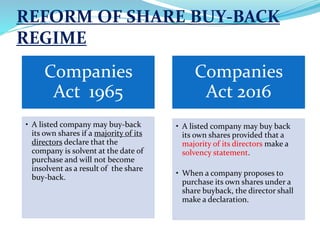

Proportion of the profits paid to the shareholders of Company. 1A Subject to subsection 1B any profits of a company applied towards the purchase or acquisition of its own shares in accordance with sections 76B to 76G are not payable as dividends to the shareholders of the company. 441E dated 29th May 2015.

Sections 1122 and 1123 of the new Act. The company is required to deposit the amount of dividend so declared within 5 days from the date of declaration of Dividend ie. Prior to omission it read as under.

Companies Act 2016. PDF uploaded 1102018 5. Key changes to the dividend regime.

Some of the features of Final Dividend are as follows. Dividends distributions and company law. It can be declared only on the recommendation of the Board of Directors.

Wide Range Of Investment Choices Including Options Futures and Forex. Rule 35 omitted by the Companies Declaration and Payment of Dividend Second Amendment Rules 2015 vide Notification No. 19032020 up to 23032020 Further the company is required to make the payment within 30 days of declaration of dividend up to 17042020 failing which company will be liable to pay interest 18 pa.

What were the scope and issues covered in the 188 Recommendations by CLRC. It is an unconditional payment. As per provisions of the Companies Act 2013 dividend is declared by the Company in the following way-.

The final authority for declaring dividend lies with the shareholders of the Company. Procedures on Resignation of Secretary under Section 237 of the Companies Act 2016. Substituted vide Companies Amendment Act 2017 dated 03012018 effective from 09022018.

And 2 the corporate rescue mechanisms. Companies Act 2006. Or d upon the application of moneys held by the company in an account or reserve in paying up unissued shares to.

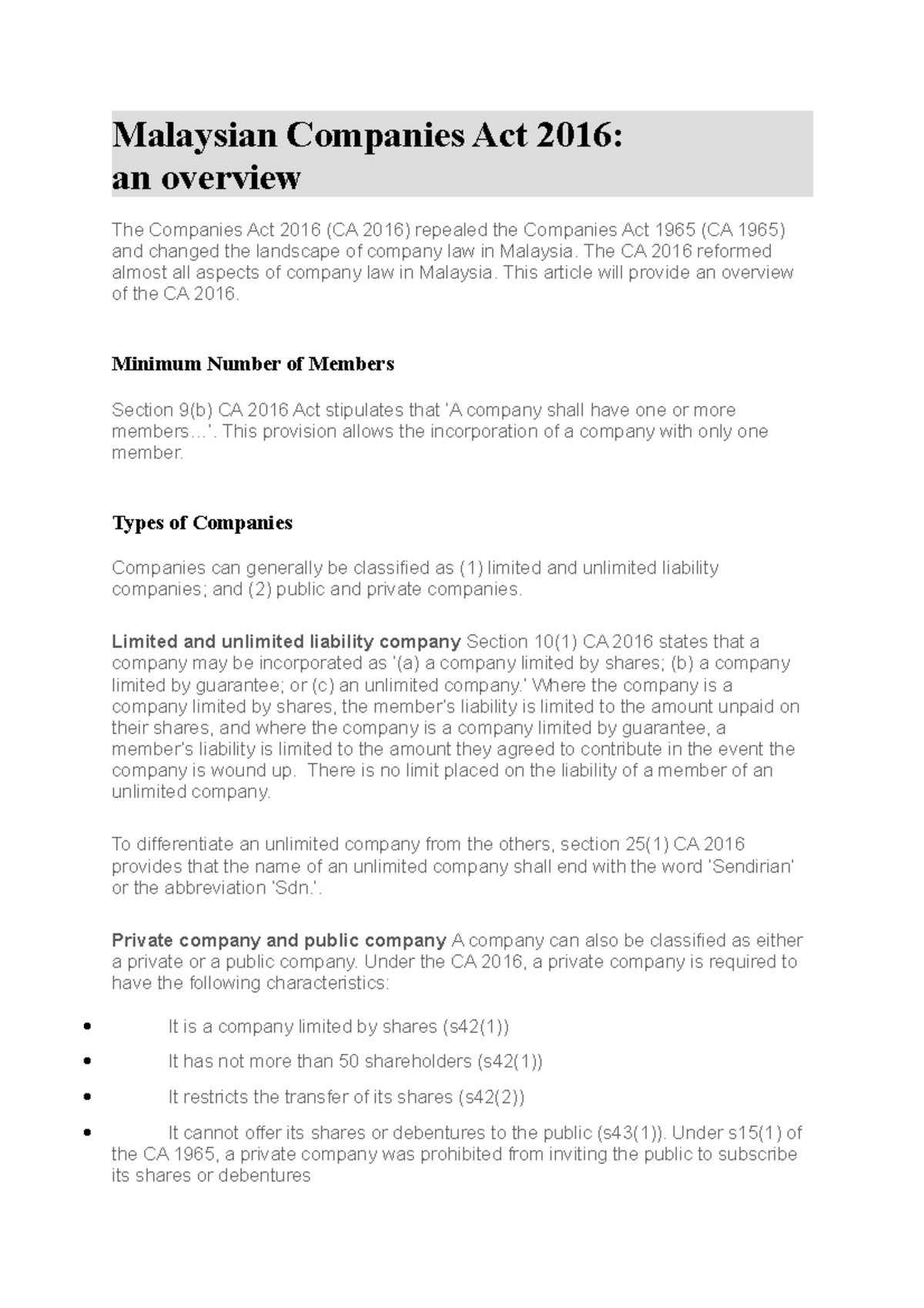

It is a share of profits of the company. Section 123 of the Companies Act 2013 provides that dividend should be declared by the company on such rate at its annual general meeting as recommended by the board. 1 No dividend is payable to the shareholders of any company except out of profits.

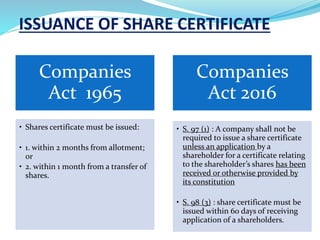

Stricter Requirements for Dividend. Whilst the new Act maintains the requirement under the Companies Act 1965 for distribution to. Dividends are sum of money to be paid to the members of the company out of the profits made by the Company.

1 The Board of Directors BOD calls a Board meeting for deciding how much dividend to declare. The Companies Act 2016. 1 the company secretarys registration with the Registrar of Companies.

In satisfaction of a dividend declared in favour of but not payable in cash to the shareholders. Queries Issued on Documents and Applications Lodged with t he Registrar. It may be noted that dividend is paid to shareholders in proportion to the amount paid-up on.

Companies Act 2016. Provision relating to Declaration of Dividend. The entire Companies Act 2016 will come into operation except for the sections on.

The Companies Acts thus do. Under the current Companies Act 1965 dividends can only be paid to shareholders. For declaration of dividend sdn bhd is.

The final authority for declaring dividend lies with the shareholders of the Company. The company will remain solvent after each buyback during the period of six months from the date of the declaration in solvency statement. 1 The Board of Directors BOD call a Board meeting for deciding how much dividend to declare.

16 April 2016 Updated. Hence effectively all companies will now have to operate under the Companies Act 2016 framework. The Board can only recommend the amount of dividend.

Equity and Preference shareholders are eligible for payments. 30092020 up to 04102020 Further the company is required to make the payment within 30 days of declaration of dividend up to 29102020 failing which company will be liable to pay. The amount of dividend approved by the board cannot be exceeded by the company.

Dividend can be declared out of profits and not out of capital. Dividend is defined under Section 2 35 of the Companies act 2013 includes any interim dividend.

Preference Shares Case Facts By Hhq Law Firm In Kl Malaysia

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

Format Of Board Resolution For Recommendation Of Dividend

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

Malaysian Companies Act 2016 The Ca 2016 Reformed Almost All Aspects Of Company Law In Malaysia Studocu

Key Challenges Ca2016 Recent Changes In Companies Act 2016 Malaysia 44 1 Jmcl The Companies Studocu

_bill_2016_1510295499_19864-17.jpg)